SPOTIFY FOR ARTISTS BLOG HOW TO

If you are not yet a MIDiA client and would like to find out how to get access to this report and data then email Posted in Amazon, Apple Music, Emerging Markets, Paid Content, Recession, Spotify, Streaming, Subscriptions, TIDAL, YouTube | Tagged DSP market shares, DSPs, Music subscriber shares, music subscribers, streaming market shares | 4 Replies Churn in the era of dynamic retention

Music rightsholders should explore creative ways in which they can empower their DSP partners with differentiated content assets, enabling them to super-serve specific consumer segments and thus unlock extra growth within them. Western DSPs have managed to grow with largely undifferentiated product propositions. The slowing growth should be the catalyst for what needs to come next, especially in developed markets: unlocking growth pockets through differentiation. It is realistic to assume that the global recession and the organic maturation of the global subscriber market will result in some slowdown of growth in 2023, even if the sector remains otherwise resilient.

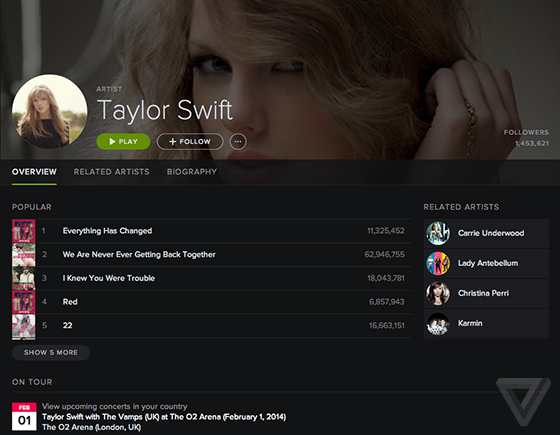

The global music subscriber market is approaching a pivot point, with the slowdown in mature, Western markets contrasting with more dynamic growth in other regions. While YouTube and Amazon both gained share in 2022, albeit it at a declining rate, second-placed Apple Music continued its long-term trend of underperforming the market, with its 84.7 million subscribers recording a 13.8% market share, down 1.2% from Q2 2021. Both gained share between Q2 2021 and Q2 2022, growing faster than the total market.

SPOTIFY FOR ARTISTS BLOG FULL

The early signs are positive (subscriber growth was stronger in the full year of 2021 than 2020), and though the first half (H1) of 2022 growth was down from H1 2021, this reflects the mature state of the streaming market in many markets, as much as it does global economic headwinds. Music subscriptions have a good chance of playing a similar role in the coming recession. In previous recessions, lipstick sales boomed, reflecting their role as an affordable luxury that consumers turn to when they can no longer afford the more expensive luxuries. Home entertainment tends to perform well during recessions, not least because people are inclined to cut down on leisure spend (eating out, bars, clubs, etc.), and thus spend more time at home. Growth, though, is uneven, with a number of leading streaming services outpacing the rest, especially the Chinese ones, which are now setting the global pace. Despite indications of slowdown in some markets, the global music subscriber market remains buoyant. Music subscriptions may be recession-resilient, as China leads the wayĪs the world edges towards a recession, the music streaming market continues to stand strong.

MIDiA has just released its annual ‘Music subscriber market shares’ report and dataset, with data for 23 DSPs across 33 different markets ( clients can access it here).

0 kommentar(er)

0 kommentar(er)